In my last post about Lending Club, I talked about how I built a lending club bot to autoinvest in loans so I didn’t have to do it manually. Here, I’ll be telling you how the bot actually makes a decision about what types of loans to invest in.

Look at historical data

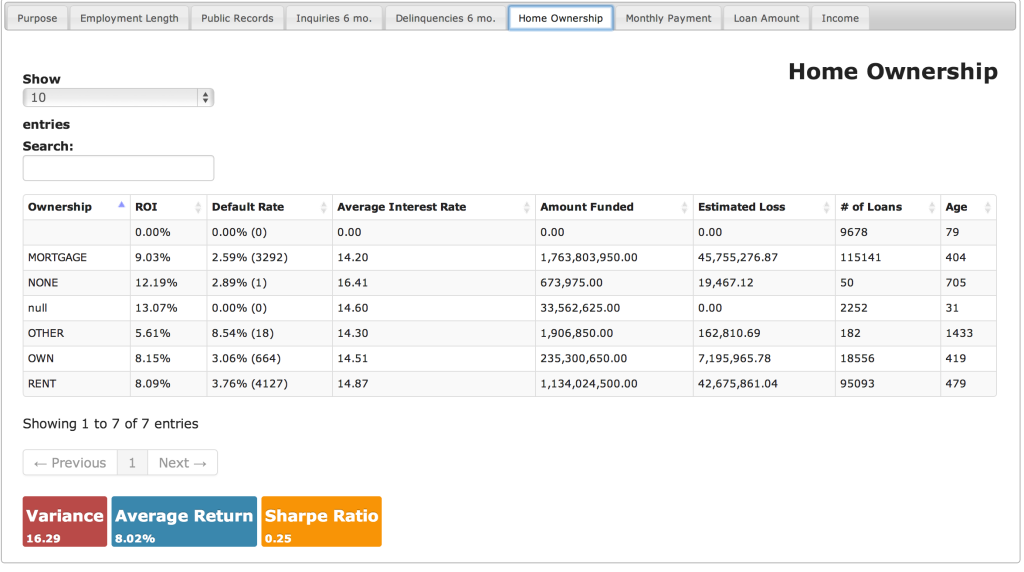

There is loads of historical data available on past Lending Club loans and there are even sites that have aggregated this data and built tools around analyzing it. My favorite of these sites is Nickel Steamroller. You can individually look at various criteria such as loan purpose, loan length, employment length, home ownership, etc and see the historical performance of notes.

What criteria to look for

So, there are 2 crucial components to look at when trying to figure out what kinds of loans to invest in: 1) the historical ROI (return on investment) and 2) the total number of loans that have been funded. Look for loans that have high historical ROIs and a large number of loans that are funded. If there isn’t a large number of loans funded, it is not a large enough sample size to make a good bet on if future loans will perform well.

If you take a look at the data above, it shows the historical data on loans based on the type of home ownership the person has. If you take a look at ownership type none, the ROI is really high and around 12.19% but there have only been 50 loans of that type funded meaning the data isn’t meaningful enough to actually bet on the performance of future notes.

The Criteria I use

I don’t mind taking a decent amount of risk on the notes that I invest in, since I am young and can recover from significant losses in the event a large number of loans begin defaulting. I can’t recommend to anyone to use my exact strategy and you will need to use your own judgement before investing in any loans.

Home Ownership Status – Mortgage

Delinquencies in the last 2 years – [0-3]

Loan Grade – [C,D,E,F,G]

Loan Purpose – [Refinancing Credit Cards, Debt Consolidation]

Min Length of Employment – [1 year]

Inquiries in the last 6 mos – 0

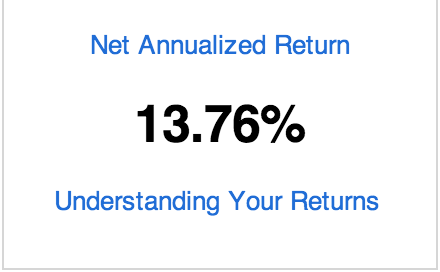

With this criteria, I have had a high net annualized return since I started investing. My current lending club net annualized return is 13.76% or adjusted net annualized return of 12.44%. However, it is crucial to remember that the way Lending Club calculates these returns assumes all of your money is invested all the time. This is why I highly recommend having a bot or the Lending Club Prime service to keep your money invest all the time.

What bot do you use?

I built it myself, you can see the details here.